Are My Vehicle's Mods Covered?

Make Sure You Read The Fine Print

Its not unusual for people to fail to report the modifications that they make to their vehicle to their insurance company. Not reporting modifications at all is a subject that deserves a dedicated article devoted to it. In this article, we will stick to giving advice on what to watch out for if you do the right thing, report your mods and get them insured. You want to really be properly insured as opposed to just thinking you are.

So lets say you submitted a list of modifications to your insurance company, turned over receipts and now your list of mods is scheduled on a rider attached to your policy. You should be in good shape to have them covered. Sadly that may not be true. We'll let this real-world example stand as a warning, and a guide on what to watch out for.

Before we begin, a bit of background to keep in mind:

- The typical Big Insurance Company covers tens of thousands of standard automobiles. Only a very small percentage of their customers are automotive enthusiasts. Of that small group, even fewer modify their vehicles. The point is that your typical Big Insurance Company knows how to deal with your car just fine, so long as its part of the standard, homogenous population. If you depart from that common standard, the typical Big Insurance Company is nowhere near as familiar with how to handle you or your needs.

- The same goes for the typical local insurance agent. A modified vehicle may be well outside of their area of expertise. You cannot take it for granted that your agent is going to get this right on the first try.

What we've said just above can make for an unpleasant experience if a claim occurs. Here's just one, related to us by a consumer we helped advise as the situation unfolded.

-----

The owner of a late-model show car had a very expensive paint job. The kind that requires you to re-paint the whole car if there is damage. Wanting protection for it, he went to his agent. The agent set him up with a special equipment endorsement that listed the paint job, covered it for a specific value and cost the owner money to add onto his policy.

Everything was fine until he had a claim.

Months later another motorist hit his car and fled the scene (and was quickly apprehended, eliminating any doubt as to the validity of the claim). The consumer was thankful he had the foresight to purchase the extra coverage as the paint was going to have to be fully redone. Unfortunately, what was expected to be a simple situation didn't turn out that way.

- The insurance company flat out refused to pay for the paint job, claiming among other things disbelief at the cost. The consumer related to us that one claims supervisor stated to him that no paint job should cost more than $300.

- The insurance company claimed they were not liable for the paint because the agent had erred and paying for the paint was his problem. The agent used an endorsement that the company said was meant for older, classic cars. It should not have been used on a late-model show car.

At about this time, the consumer came to us and asked for some advice and help dealing with the situation.

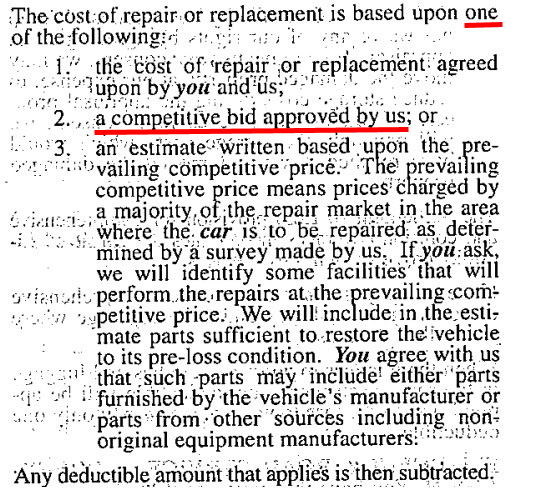

We and his attorney were able to help some, but in the end, while the carrier softened their position, they fell back onto a clause in the policy (click to enlarge) that contained a surprise with regard to how the damage would be paid. As soon as we read this, we knew that Item #2 was the only one that mattered. Translated into plain English it reads "We will pay what we feel like."

Which is what they did. The consumer lost his showstopping custom paint job. Regardless of the insured amount listed in the endorsement, the company simply refused to pay. On the advice of his attorney he accepted the offer they gave to him (which was to put a conventional gloss black on the car... at least it was a full repaint). This was the best he was going to get without taking them to court, and the poor guy just didn't have the resources or the will to keep fighting.

What happened here?

- The agent made a mistake.

He was familiar with standard autos, looked up a catalog of available policy endorsements and picked the one he honestly thought would do the job. Remember... we see mistakes like this often. Agents are not being dishonest... they are just operating outside of their box and their success rate suffers as a result. - The insurance company didn't understand its customer.

When you hear comments from claims people about how a paint job can't cost more than a few hundred dollars, thats someone who is not used to dealing with fine automoboiles, and is completely out of their league. Some education would cure that attitude, but don't expect that out of a standard Big Insurance Company. - The insurance company fell back onto the policy language as its last resort.

The consumer consulted both us and an attorney, and this enabled him to get the insurance company to back off of its hard line. However, in the end they pointed to the policy language itself and used it as a weapon to get most of what they wanted.

What lessons are here to be learned?

- Deal with an agent who is experienced in the niche of modified/specialty vehicles.

There is no substitute for experience, and the typical agent does not do this sort of thing very often. More often than not general agents know to hand off these sorts of specialty jobs to others who know this kind of risk inside and out. Agents like us here at Leland-West. :-) - Yes, you could sue and would probably win. Eventually.

Put simply the insurance company was legally in the wrong. The consumer could have kept paying that attorney, and sued both the company and the agent (the agent's Errors & Omissions policy provides a source of recovery for what is, essentially, malpractice). But you have to be willing to spend the money and let the situation play out over time. There's got to be a better way. Which leads directly to... - Deal with an insurance company who expects to be working with modified/specialty vehicles.

Admittedly these are few and far between. However, if you want a modified-from-stock vehicle properly protected, you need to exercise extra due diligence to make sure that the situation above doesn't happen to you. Above all, make sure the modifications are insured for an Agreed Value.

Matt Robertson